With corporate clients keen to get back to live events and enquiries on the rise, many event agencies will be looking to freelancers for support to manage increasing workloads. But recent changes to the IR35 legislation mean they might have to change the way they pay and tax freelancer workers.

Last week, micebook held a session for members of our nineteen agency leaders club, with Grant Thornton’s Director, Employment Tax Jonathan Berger and Associate Director, People Consulting Bethan Gill to talk through what the changes could mean for the events industry. Here are some of the highlights…

What’s changed?

In a nutshell, IR35 allows HMRC to collect additional payments where a contractor is an employee in all but name. It is designed to close a loophole in the tax system where workers could use the setup of a limited company structure in order to pay less tax.

The new IR35 changes came into force in April 2021 for private sector contractors and transfer responsibility from contractors to the end client to assess IR35. The 2021 reform brings private sector IR35 in line with the public sector, where the reform was implemented in 2017.

IR35 does not apply to small businesses who are end users, defined as satisfying two or more of the following tests:

– annual turnover not exceeding £10.2m

– balance sheet total not more than £5.1m

– had an average of no more than 50 employees for the company’s financial year.

Medium to large companies, which includes event agencies using freelancers, are now required to assess and determine the employment status of freelancers working for the business, decide whether PAYE and national insurance is owed, and withhold that.

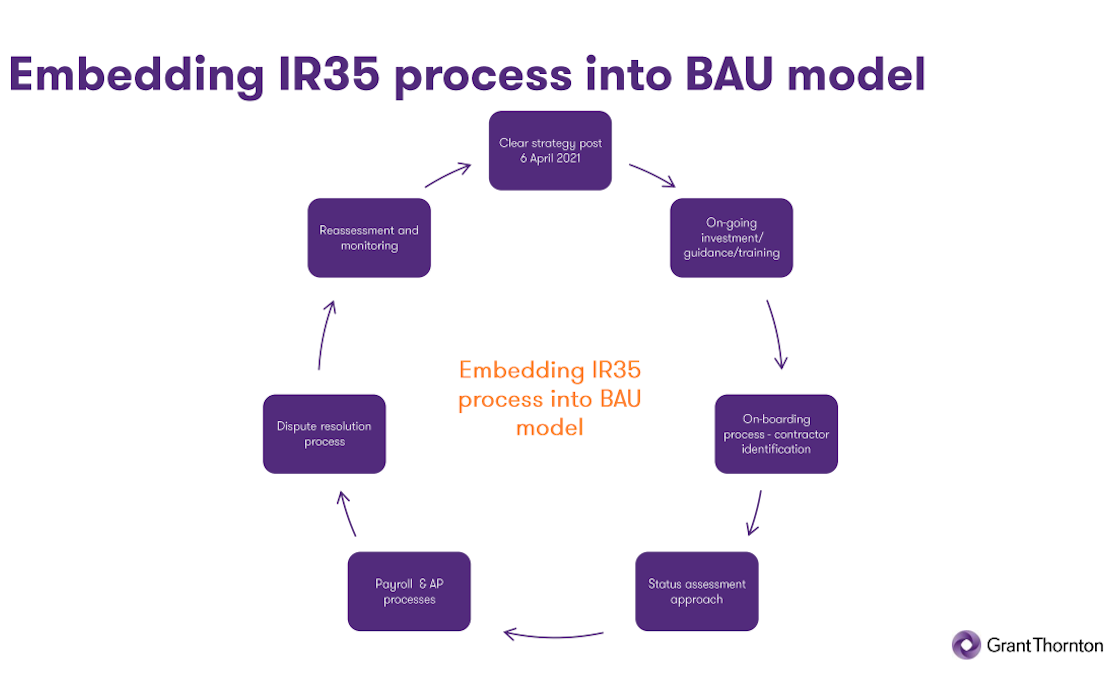

Top tips for focusing your time:

- Ensure full understanding of impact of IR35

- Communication with all stakeholders

- Ensure continuing input from all relevant teams – tax, finance, HR etc

- Continue to Identify the contractor population on a business-as-usual (BAU) approach

- Revisit the process adopted to date – is there a better way?

- This isn’t just about doing assessments

- Manage the dispute process

In detail

An assessment of employment status needs to be made on each engagement with a contractor irrespective if you have used them before. The assessment is designed to determine that if there was not a limited company involved, would this be deemed an employee-employer relationship?

Berger said: “One of the biggest challenges is how you actually carry out that assessment.” There is a statutory requirement to take ‘reasonable care’ when making the employment status determination.

The responsibility to make the assessment lies with the end user, not with intermediaries such as recruitment agencies, and it is the working practice of the contractor that needs to be assessed. IR35 applies where a worker personally applies services to an end user.

The assessment should take factors such as whether the contractor pays for their own equipment and insurance etc, and there are various tools to help with assessments including the HMRC’s CEST tool, though Gill says it has limitations. Grant Thornton has developed its own tool called Employment Status Intelligence Platform (ESIP)

As event agencies provide services to an end-client, we discussed if the responsibility lies with the agency or the corporate client? Who is the end user in this case? Berger said that it depends on how the service that freelancer is providing is packaged and presented to the client.

“If they are outsourcing a project to you, and it’s up to you how you resource that project and they are not the end client of any personal service, then the liability is on you,” he explained. “If you say, John Smith is going to be providing the video on this daily rate, then the end client knows they are receiving a personal service from that contractor so the liability would be on them.”

Once you have assessed freelancers, you have to provide them with a status determination statement (SDS) to confirm if the services they are providing are inside or outside IR35 and why.

You must have a Dispute Resolution Process in place to enable contractors to appeal against the assessment, and they can raise a dispute any time after they receive the SDS until the final payment under the arrangement is made. You will then have to respond to that contractor within 45 days.

Gill concluded: “Make sure you are very clear about the process you set up and keep records. That audit trail is going to be really important to make sure you can justify the decisions that have been made and to demonstrate to HMRC that you are taking it seriously.”