The events industry is full of self-employed people and freelancers who were waiting for last week’s government announcement on the financial support that would be provided to self-employed people affected by the Covid-19 pandemic. Jonathan Wall, founder and managing director of accountancy firm Ellman Wall, which specialises in the travel industry, gives his take on what was announced…

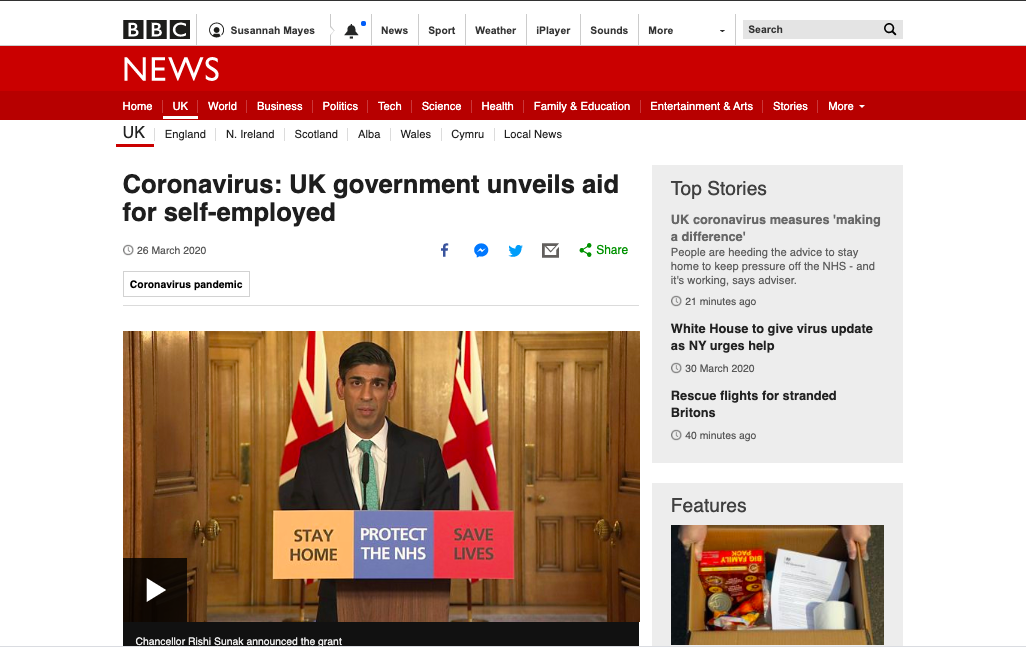

In an attempt to convince the self-employed that they were not being forgotten, the Chancellor has announced a new support package designed to cover around 95% of the self-employed.

Details are now awaited but we have the outline of how this business sector will benefit. Eligibility will be conditional.

- Firstly, this is designed to be specifically targeted for those who are reliant on self-employment, as opposed simply being for anyone who is self-employed. Accordingly it applies where the majority of income is from self-employment. It remains however to be seen how this works. For example take someone who for a non-Covid-19 genuine reason their last reported profit from self-employment was low, or even generated a loss. That may mean the majority of income is not from self-employment.

- Secondly, a tax return for the year ended 5 April 2019 needs to have been filed. For those who have not yet filed the 2018/19 tax return a 4-week extension from yesterday is now granted. This is to ensure only those with a genuine self-employment history can participate.

- Thirdly, it will be available to anyone making a trading profit of up to £50k. This has a possible twist. The 2018/19 tax year encompasses a range of trading year ends – in theory everything from 6 April 2018 to 5 April 2019. So potentially someone who last drew up accounts almost two years ago could be prejudiced by having a profit of £51k compared to what may have happened in the year to April 2019 or indeed now.

This Self-Employed Income Support Scheme will pay a grant of 80% of average monthly profits over the last three years, up to £2,500 per month.

So, for someone who has average annual profits of £50k, or £4,167 per month, they will receive £2,500. This is the same as someone who has average annual profits of £37,500, so it’s not entirely clear why the £50k cap. Except that the average earnings of those above £50k are stated to be £200k

The scheme will run for an initial three months. In contrast to the treatment of furloughed employees, to the extent that it remains possible, which is probably unlikely, the grant can be claimed as well as continuing to do any business.

This grant however comes with a few stings and a warning.

- Firstly, the grant will be taxable. In theory this is designed to replace lost profits, so perhaps this stance is understandable. At least there is no deduction at source, and under normal self-assessment procedures, any tax on this is only likely to be paid in January 2021 or July 2021 at the earliest.

- Secondly, due to the complexity of running such a scheme, and ensuring any exposure to abuse is minimised, access to the grant is unlikely to be available prior to the beginning of June. HMRC will contact relevant individuals and will make payments directly following on from that. Nonetheless June seems a long, long time away.

- Thirdly, The Chancellor made a clear suggestion that National Insurance is likely to rise for the self-employed in the future, as the inconsistencies in status between employees and the self-employed is looked at and sought to equalise.

So some good news for the self-employed but the long wait until June is worrying. In the meantime, applications for for Universal Credit can be made with a guarantee that it should not take the usual 5 weeks for money to come through. The advance payment system should allow funds to be paid within ‘days’.